Our Concept

Rethink Retirement. Rethink Debt. Discover Infinite Banking.

Are you 100% confident that your retirement is secure—or do you have doubts?

If you’re worried about your financial future, you’re not alone. Many Americans are stuck on a treadmill—working hard, paying bills, and trying to get ahead, but struggling under the weight of debt, taxes, inflation, and rising costs.

Here’s the truth: Traditional financial advice isn’t working. But there’s a better way.

At Love Financial Inc., we teach the Infinite Banking Concept (IBC)—a powerful, proven strategy that helps you take control of your finances, eliminate debt, and build wealth using a tool the wealthy have used for generations: a properly structured whole life insurance policy.

With IBC, you don’t have to spend more money—you simply redirect what you're already spending into your own financial system. That means you can:

* Be out of debt in 9 years or less—including your mortgage

* Eliminate interest payments to banks and lenders

* Create a private banking system you control

* Grow your money consistently and securely

Why IBC Works

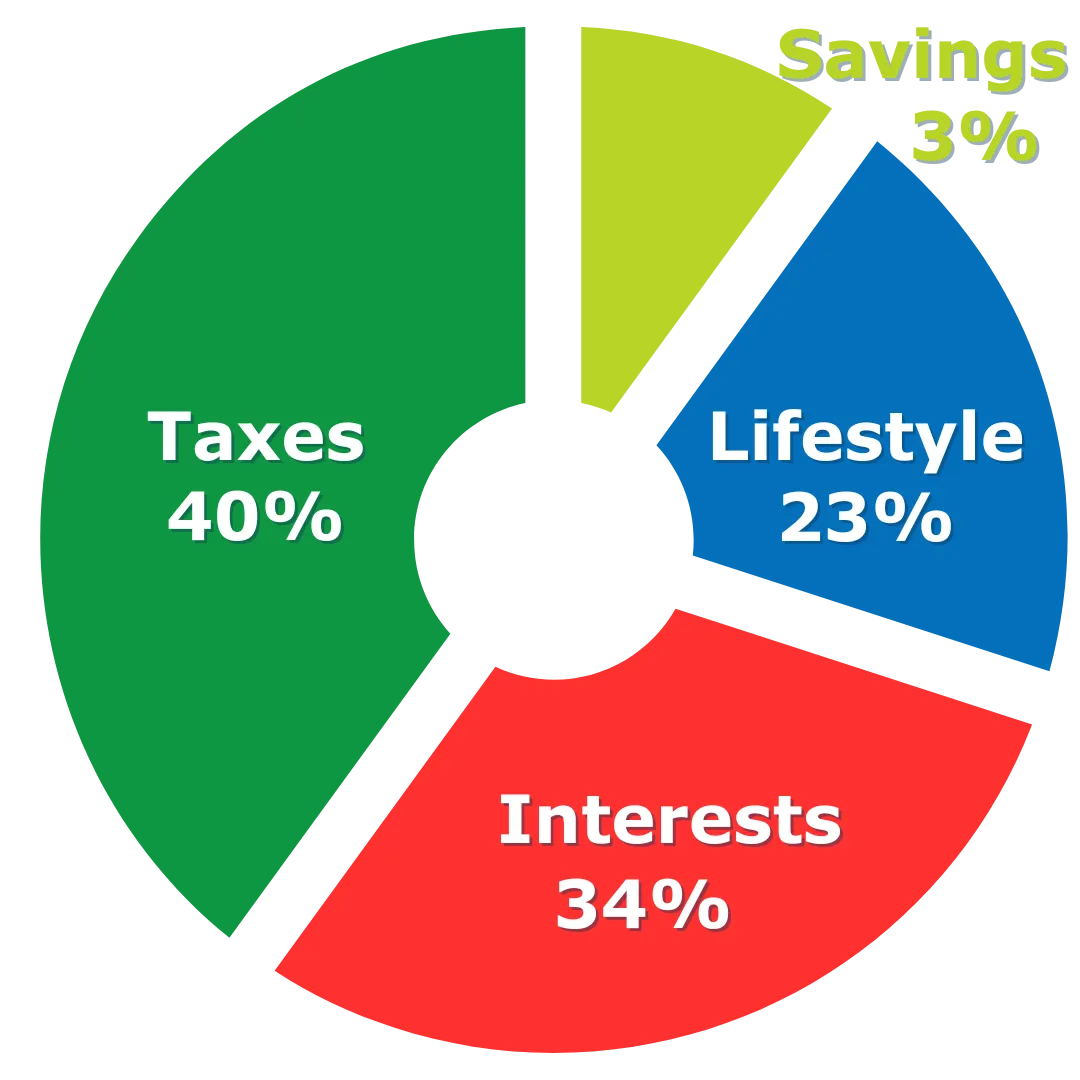

The average American gives away:

34% of their income to interests (mortgages, car loans, credit cards, student loans)

40% to taxes (income tax, sales tax, capital gains, gas tax, and more)

That leaves only 23% for lifestyle—and just 3% goes to savings.

Most financial advisors focus on increasing that 3%. But we focus on reducing the 34% going to interest and the 40% going to taxes. By addressing the real problems, we help you free up cash flow and put your money to work for you.

Banks Don’t Save—They Leverage. You Can Too.

When you deposit $10,000 into a bank, they might pay you 1% interest. But if you walk in the next day to borrow $10,000, they’ll charge you 5%, 12%, or even more—depending on your credit, the loan purpose, and other factors.

The bank makes a profit using your money.

With Infinite Banking, you become the bank. Your money earns guaranteed compounding growth inside your policy—even when you borrow against it.

That’s the power of giving every dollar two jobs:

Earn uninterrupted compound interest

Provide liquidity to fund major expenses, pay off debt or invest

This is how the wealthy manage money—and now, you can too.

If you're tired of the financial hamster wheel and want a better path to freedom, we're here to help

Learn how Infinite Banking can transform your financial future.

Copyright 2018 Love Financial all rights reserved.

Love Financial is an Authorized Agent of Your Family Bank